Good Debt vs. Bad Debt

Understanding the difference.

Our two cents

It might sound strange, but not all debt is "bad." Certain types of debt can actually provide opportunities to improve your financial future.

To make smart decisions about if, when, and how much to borrow, you need to understand the difference between "good" and "bad" debt and how to manage it. That way, you can avoid being part of the negative debt statistics in America:

- Total housing debt is about $12.52 trillion and non-housing debt nearly $4.87 trillion.i

- Americans are paying an average credit card interest rate of 24.4%.ii

- The average household with debt owes $7,951 on their credit cards.iii

- Almost half of Americans carry a balance on their credit cards.iv

- About a third of auto loans for new vehicles have terms of about five and a half years.v

It pays to pay off debt.

It's not all bad

Good debt should ideally be in low amounts, low cost, help you achieve your financial goals, and have potential tax advantages. Here are two examples:

- With mortgages, interest rates are low compared to other types of consumer debt, and owning your own home can help you build wealth over time as well as improve your quality of life. For example, it could shorten your commute or allow you to move into a better neighborhood or school district. Mortgage interest may be deductible. If you use a home equity line of credit or HELOC for home improvement, you may still be able to deduct the interest if the money is used for improving your residence. As always, be sure to check with your tax advisor.

- With student loans, rates are comparatively low, and interest can be tax-deductible, depending on your income. Benefits include enhanced career opportunities, which may increase your earning potential in the long run.

How to Pay Off Debt

Watch video: How to Pay Off Debt

On this episode of Personal Finance 101, we take a look at Schwab’s suggestions for how to manage your debt wisely.

Debt that can work against you

Generally speaking, try to minimize or avoid debt that is high cost and isn't tax-deductible, such as credit cards and some auto loans.

- High interest rates will cost you over time. Credit cards are convenient and can be helpful as long as you pay them off every month and aren't accruing interest.

- If you finance any car purchase, be careful about the length of the loan. With a new car, understand that you're borrowing to purchase something that will likely lose value as soon as you drive it off the lot. A used car is usually more cost effective but still loses value over time. Do your research to make sure you're getting the best annual percentage rate or APR possible and choose a vehicle you can truly afford.

- Too much debt can turn good debt into bad debt. You can borrow too much for important goals like college, a home, or a car. Too much debt, even if it is at a low interest rate, can become bad debt. Carrying debt without a good plan to pay it off can lead to an unsustainable lifestyle.

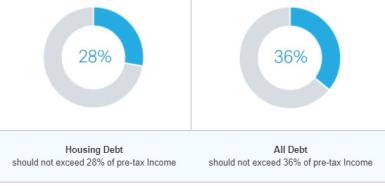

Safe debt guidelines

©2026 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

Guidelines to help manage debt

- If your debt is…

- Then…

-

If your debt is…30% or less of your pre-tax incomeThen…You're in good shape

-

If your debt is…Between 31% and 36%Then…You're doing OK

-

If your debt is…Between 37% and 40%Then…Beware, you're on the borderline

-

If your debt is…More than 40%Then…Red flag warning

© 2026 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

Keep learning

i. New York Federal Reserve Center for Microeconomic Data (Q1 2024)

ii. Schulz, Matt, “Average Credit Card Interest Rate in America Today” LendingTree, 7.8.24

iii. Luthi, Ben and Saks Frankel, Robin, “What is the average credit card debt?” USA Today, 7.1.24

iv. Kelton, Katie, “Almost half of Americans are in debt. Is doom spending to blame?” Bankrate, 5.10.24

v. Davis, Maggie, “Average Car Payment and Auto Loan Statistics 2024,” LendingTree, 6.20.240624-1EZE

Investment and Insurance Products Are: Not FDIC Insured • Not Insured by Any Federal Government Agency • Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or any of its Affiliates • Subject to Investment Risks, Including Possible Loss of Principal Amount Invested