Enjoying Retirement

You've worked hard to get there. How do you make the most of it?

Our two cents

Once you reach retirement, your planning doesn't stop. You need to be thoughtful and careful about how you use your hard-earned savings.

Enjoying retirement means making sure you have the money you need to maintain the standard of living you want. To do this, you have to balance your income and spending while managing your investments wisely.

Follow this checklist to make the most of your retirement savings.

Create a regular income stream.

Start by drawing income from sources other than your portfolio. These can include Social Security, pensions, income property or part-time work. Then start tapping into your portfolio.

Think of it as writing your own retirement paycheck. As a guideline, consider drawing funds in this order:

Draw from interest, dividends, as well as from bonds and CDs maturing in the next 12 months.

Take required minimum IRA distributions if you've reached the age set by IRS rules.

- Rebalance your portfolio yearly and sell overweighted assets in your taxable accounts.

- Sell from your tax-advantaged accounts—first traditional IRAs, then Roth IRAs.

Stay flexible with a laddered approach to bond investing.

To generate income at regular intervals, you can create a bond ladder of high-quality bonds with maturities of 1 year to 5–10 years.

Laddering means buying bonds or notes that mature on different dates. It has two important goals:

- Minimize risk—By staggering maturity dates you avoid getting locked into a single rate. You're protected if rates drop, but you can still capitalize on the opportunity if rates go up. And diversifying your holdings protects you from overall credit risk because you're not lending all of your money to one issuer.

- Manage cash flow—A ladder enables you to manage cash flow for your particular needs. For instance, since many bonds pay interest twice a year, you can structure a monthly income based on coupon payments from laddered bonds by picking bonds with different maturity dates.

Rebalance your portfolio annually and review your asset allocation plan.

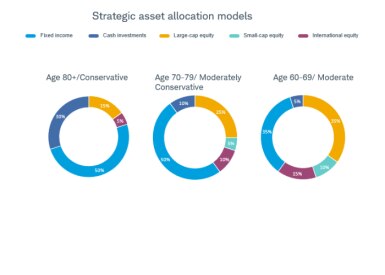

Rebalancing your portfolio to control risk and stay on track with your goals is important at any age. In retirement, rebalancing can include shifting to a more conservative investing approach.

For instance, early in retirement when you may have higher expenses, you may be willing to take on increased risk in exchange for the potential for more growth. As the years go on, you can adjust your asset allocation to reflect your shorter time horizon.

Source: Schwab Center for Financial Research.

Generate additional cash by selling overweighted asset classes.

You can take care of some of your cash flow needs at the same time you rebalance your portfolio each year. As you reallocate your assets, take out the cash you need. For example, say your target allocation is 60 percent stocks and 40 percent bonds—but your portfolio has drifted to 65 percent stocks and 35 percent bonds. You could cash out what you need from the stock portion and then reallocate what's left over to bonds until you're back on target.

Start taking required minimum distributions (RMD) at the required age.

RMD is the minimum amount that you must withdraw each year. By federal law, Traditional, SEP, SIMPLE and Rollover IRA account holders, and participants in some qualified retirement plans must begin taking distributions no later than April 1 in the year following the year in which they turn the required age. Your required age depends on your birth year and may change in the future. You can check to see when you must begin taking your RMD at the IRS website. Roth IRAs are not subject to RMD. All shortfalls from the RMD are subject to a penalty tax.

While you're required to take your RMD annually, it can be taken from either one IRA account or multiple IRAs. There are several considerations in calculating your RMD. Talk to your tax advisor or go to IRS.gov.

Periodically review your health and life insurance coverage.

For your own peace of mind, make sure that the health insurance you have is adequate for your needs—and that you're getting the best coverage for your money. Especially when it comes to prescription drug coverage under Medicare, it's smart to review alternate plans during open enrollment periods.

Then there's the question of long-term care insurance (LTC). According to the U.S. Department of Health and Human Services, at least 70 percent of people over age 65 will require some type of long-term care services at some point in their lives. LTC insurance can be expensive. Premiums for LTC vary widely, depending on where the insurance is purchased, the age and health of the buyers, inflation options, and the specific type of insurance purchased. It may not be right for you, but it doesn't hurt to get the facts.

Finally, take a look at your life insurance needs. If you no longer have dependents relying on your income or future expenses that need to be covered, the money you're putting into life insurance may be better used in another way.

Make sure your estate plan and beneficiary designations are up to date.

If you don't have an estate plan in place, create one now. It will give you peace of mind and may help keep harmony in your family.

If you do have a plan in place, you may want to review it to make sure it's up to date and accessible. Here are some practical considerations:

- Verify that your will or trust is current, especially if there have been any changes in family circumstance such as marriage, divorce or the birth of a grandchild.

- Update named beneficiaries on all government entitlements (such as Social Security), retirement accounts, disability and life insurance policies, bank accounts, and annuities. (You don't want assets inadvertently going to an ex-spouse.) It's also a good idea to name secondary beneficiaries.

- Make sure a trusted and competent family member or friend knows where important documents and records are kept and has access to them.

- Name a trusted contact as a second line of defense for your financial accounts. This can be useful to you if the financial institution is either unable to reach you for critical financial information or have concerns about your well-being or see uncharacteristic financial behavior in your accounts.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors.

Investing involves risk, including loss of principal.

The information and content provided herein is general in nature and is for informational purposes only. It is not intended, and should not be construed, as a specific recommendation, individualized tax, legal, or investment advice. Tax laws are subject to change, either prospectively or retroactively. Where specific advice is necessary or appropriate, individuals should contact their own professional tax and investment advisors or other professionals (CPA, Financial Planner, Investment Manager) to help answer questions about specific situations or needs prior to taking any action based upon this information.