Why You Should Save and How Much

Save early and often.

Our two cents

Whether you're working toward a short-term goal or retirement, the sooner you start, the better.

Here's why: The earlier you start saving, the smaller the percentage of your income you need to save. Conversely, the longer you wait, the larger the amount of your salary you're going to have to put away each year to reach your goal.

Start with 10%—and go up from there

Saving 10% of your income can be a good guideline for getting started, especially if you're under 30. However, the later you begin to save, the more you should set aside.

Consider this example:

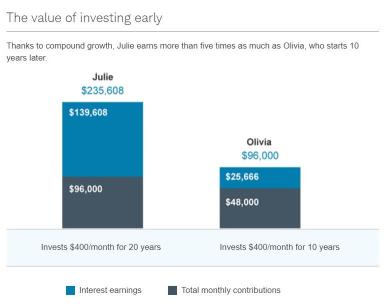

Let's say that two sisters, Julie and Olivia, each save $4,800 a year. Julie starts to invest immediately and puts away a total of $96,000 over 20 years. At that point, she stops saving and leaves her money to grow for the future. At that point, Olivia begins to save the same amount for 10 years.

If each sister makes a consistent annual interest rate of 8%, their results, which you can see below, will be very different. What made the difference? The power of time and compound interest.

For illustrative purposes only. Hypothetical example assumes a consistent annual growth rate of 8% compounded monthly. Inflation, taxes, and expenses are not factored in. Not meant to predict or project the performance of any specific investment product.

© 2024 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.

Find out what it will take to reach your goals

No matter what you're saving for—a car, a vacation, a down payment on a house, or retirement—determine what it will take and how long it will take to reach your goals. Use our Savings Calculator for an easy way to get started.

Make saving a habit

Once you've gone through the budgeting process and understand where your money goes each month, start thinking about saving for the future. People who learn to save when they are young have a valuable head start. But no matter where you are in life, it's never too late to get on the right path.