Benefits of Compound Growth

Put time on your side.

Our two cents

Investing isn't just about how much money you have to invest. It's also about how much time you have to invest it. That's because of the power of compound growth.

A simple definition.

Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal. Compounding can create a snowball effect, as the original investments plus the income earned from those investments grow together.

As a rule of thumb, to see how long it takes for your savings to double you can use the "Rule of 72." Simply divide 72 by the expected rate of return. For example, if your investments returned 6% annually, you would double your investment about every 12 years.

The more time, the more growth potential.

The higher your starting amount and the higher your investment return, the faster your savings compound. And over time, it can seriously add up. Saving early and often can put the power of compound growth in your favor by putting your money to work—so you don't have to!

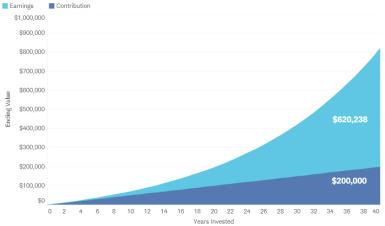

The power of compounding – Investment earnings can help your savings grow

Source: Schwab Center for Financial Research. This chart shows the outcome of saving $5,000 per year for 40 years. Savings are assumed to be placed in a hypothetical portfolio that earns 6% per year. Taxes and fees have not been considered in this analysis. Including them will impact the ending value. This is a hypothetical example for illustrative purposes only. The actual annual rate of return will fluctuate with market conditions. Investing involves risk, including loss of principal.

© 2024 Charles Schwab & Co., Inc. All rights reserved. Member: SIPC. (0121-14WM)

(0324-RK61)

Keep Learning

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.