Managing Income and Investments

Stay ahead of changing finances.

Our two cents

As people get older, it's generally recommended that they invest more conservatively. That's because they need to use their investments to, in effect, write their own paycheck. To help your parents try to maintain a reliable source of income, talk to them about their investments and encourage them to consult with a financial advisor.

Here are some basic ideas to help them—and you—feel more secure about their financial future.

Simplify—There's no need to manage multiple accounts in multiple financial institutions. Consolidating accounts at a single bank or brokerage firm can make it easier to stay on top of investments, earnings, and withdrawals, but consider all your choices before making a decision. Read about the pros and cons about rolling over and consolidating assets here.

Keep enough cash and cash investments on hand—Ideally, your parents should have one year's expenses in a relatively safe and accessible account, such as a checking or savings account, or a money market fund. It can also be a good idea to have enough to pay for two to four years of expenses saved in high-quality, short-term bonds, CDs, or other stable, liquid investments.

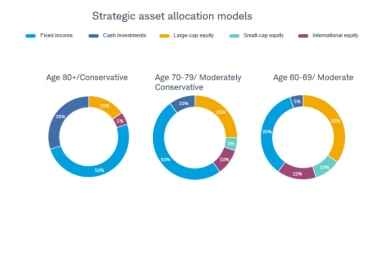

Review investments—Generally speaking, the older people are, the more conservative their asset allocation should be. That means investing less money in stocks and more in income-producing investments.

Source: Schwab Center for Financial Research.

Focus on all sources of income—Look at all sources to provide a steady income stream.

Ways to do this could include any of the following:

- Income funds. Invest in mutual funds specifically designed to provide income while preserving growth.

- Laddering. Create a ladder of high-quality bonds, bond funds or CDs with maturities of one to seven years to generate income at regular intervals.

- Annuities. Outside of a pension plan, an annuity is the only product that can guarantee income for life.1

- Social Security. Claiming too soon can mean less money if parents live a long time. They should think carefully about the choice of when to start their benefits.

1. All guarantees are subject to terms and conditions of the contract and backed by the financial strength and claims-paying ability of the issuing insurance company, not Schwab.

Investing involves risk, including loss of principal.

Funds deposited at an FDIC-insured institution are insured, in aggregate, up to $250,000 per depositor, per insured institution based upon account ownership by the FDIC. The FDIC considers any other deposits you may have with an issuing bank. CDs you purchase from a particular bank are aggregated with any other deposits you may have with the issuing bank for determining FDIC insurance coverage. Because the deposit insurance rules are complex, you may want to use FDIC's online tool, Electronic Deposit Insurance Estimator (EDIE), to estimate your total coverage at any particular bank. Certain conditions must be satisfied for FDIC insurance coverage to apply.

Charles Schwab & Co., Inc. is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank.

Certain conditions must be satisfied for FDIC insurance coverage to apply.